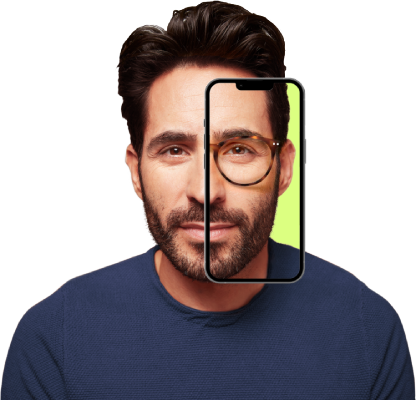

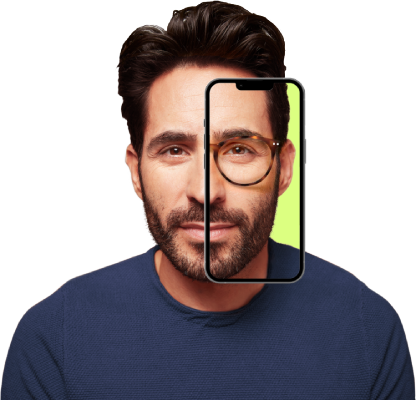

With our virtual try-on tool, finding your perfect pair is as easy as looking into your camera.

Everything you need to know to take care of your eyes — for life.

Your vision benefits are only as good as your ability to use them wisely. Here’s a detailed guide on how to maximize the coverage you have.

Maybe you didn’t need glasses before, or you didn’t have eye-health coverage until now. Whatever the reason for not understanding the nuts and bolts of how your vision insurance plan works, America’s Best makes it easier to use it than you might imagine.

To save money and streamline your next visit, here is everything you need to know and what to expect — from the time you make an appointment until the moment you place the order for your new glasses or contacts.

Have questions about your vision or eye health? Talk to your America’s Best optometrist, who is an important part of your care team. Find an exam time that fits your schedule!

We accept most major plans, but it’s still a smart idea to ask an associate to confirm that your vision insurance is accepted. A good time to do so is when you call to make an appointment, but you can also ask when you arrive.

If America’s Best is not in your provider’s network, you shouldn’t worry, says Mike Vaughan, an optician and retail operations manager with America’s Best Contacts & Eyeglasses in Atlanta.

“Our everyday deals are meant for folks who don’t have insurance coverage, so they can still afford to take care of their family’s vision,” says Vaughan.

If your plan isn’t accepted or you don’t have any vision insurance, you’ll still be able to take advantage of America’s Best popular everyday offers, such as included eye exams with any two pairs of eyeglasses and discounts offered to our Eyecare Club members.

There are other offers available even if you do use insurance, such as receiving 50% off your second pair of eyeglasses.

Once you’ve confirmed that your insurance plan is accepted, you can learn more about the details of your vision coverage in one of two ways:

When speaking to your insurance provider, be sure to ask these key questions:

Once you know what your plan covers, you can book an appointment either by telephone or online. Here’s how to find a store near you.

If you have a current contact lens prescription or eyeglasses prescription, you don’t even need to schedule an appointment. Simply stop by your nearest America’s Best store in person when you need a new pair of frames or contact lenses. (Vision insurance is not accepted when buying contact lenses or frames online.)

If you didn’t have time to call your insurance company before your visit — or if you aren’t even sure who that is — the store associates can help identify your insurance provider for you. Be sure to bring your driver’s license or other state-issued ID card. They will ask you some questions and plug that info into a system that will find your insurer.

The America’s Best associates are a fountain of cost-saving knowledge, so ask them questions before you place your order for glasses or contacts. Since our everyday offers may reduce out-of-pocket costs better than your insurance plan, your associate can cross-reference the two, provide a cost breakdown, and help determine which options are the best value for you.

With our virtual try-on tool, finding your perfect pair is as easy as looking into your camera.

If it’s determined that your vision insurance plan provides the best value, your America’s Best associate will submit the insurance claim on your behalf. You’ll receive a bill later for any vision care expenses that weren’t covered.

If you have a flexible spending account (FSA) or health savings account (HSA), you can use it to pay for the remaining costs. Learn more here.

That’s it! Using vision insurance benefits at America’s Best is just one of the many ways we can help you save on your family’s vision needs.

Recommended reading:

6 Tips for Buying Contact Lenses Online at America’s Best